The financial world is evolving rapidly, with digital assets like XRP gaining traction among businesses and financial institutions. But how does XRP compare to traditional fiat currencies like the U.S. Dollar, Euro, and Japanese Yen? Understanding the differences between XRP and fiat money is essential for those exploring alternative financial solutions.

Fiat currencies have been the backbone of global trade and commerce for centuries. However, XRP offers a new-age approach with benefits such as faster transactions, lower costs, and decentralized governance. This article provides an in-depth comparison of xrp price prediction and fiat currencies, helping individuals and businesses make informed financial choices.

Key Differences Between XRP and Fiat Currencies

Governance and Control: Centralization vs. Decentralization

One of the most striking differences between XRP and fiat currencies lies in their governance structures.

- Fiat Currencies: Central banks and governments issue and control fiat currencies, managing their supply through monetary policies. These policies regulate inflation, interest rates, and economic stability. However, centralization also exposes fiat currencies to risks such as devaluation and excessive inflation due to overprinting.

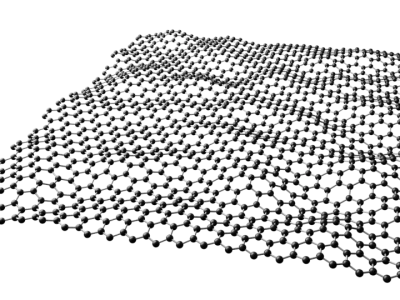

- XRP: Unlike fiat currencies, XRP operates on the decentralized XRP Ledger. While Ripple plays a role in its technological development, it does not have direct control over the currency. This decentralized nature enhances security and minimizes risks associated with centralized manipulation.

Transaction Speed and Cost

Transaction efficiency is a critical factor in financial operations, and XRP significantly outperforms fiat currencies in this aspect.

- Fiat Currencies: Traditional transactions, especially international ones, involve multiple intermediaries, leading to slow processing times and high fees. Cross-border payments can take several days, and transaction costs can be substantial due to bank fees, exchange rate fluctuations, and regulatory compliance.

- XRP: XRP transactions settle within 3 to 5 seconds, making it one of the fastest digital assets for global payments. Additionally, the transaction fees are minimal—approximately 0.0002 XRP per transfer—eliminating costly intermediaries and improving overall efficiency.

Transparency and Security

Trust and security are vital in financial transactions. Both XRP and fiat currencies approach these factors differently.

- Fiat Currencies: The traditional banking system relies on centralized institutions like SWIFT for processing payments. This system lacks transparency, as users cannot always track their transactions in real time. Additionally, the involvement of multiple financial intermediaries increases fraud risks.

- XRP: Since XRP transactions are recorded on a public ledger, they offer complete transparency. The blockchain-based system ensures that transactions are secure, tamper-proof, and verifiable, reducing the risks of fraud and unauthorized access.

Supply Mechanism and Inflation

The way fiat currencies and XRP control supply affects their long-term value and stability.

- Fiat Currencies: Central banks have the authority to print more money as needed. While this helps regulate economic conditions, it can also lead to inflation and loss of purchasing power if excessive money is introduced into circulation.

- XRP: XRP has a fixed supply of 100 billion tokens. No additional XRP can be created, preventing inflation due to overprinting. This controlled supply mechanism enhances XRP’s value preservation potential over time.

Use Cases and Adoption

While both XRP and fiat currencies serve financial purposes, their applications vary significantly.

-

- Fiat Currencies: Fiat money is universally accepted for everyday transactions, including retail purchases, bill payments, and government services. It remains the default currency for most financial transactions.

-

- XRP: xrp price prediction is primarily used for cross-border payments and financial institution liquidity solutions. Its efficiency in remittances and international transfers makes it a valuable tool for banks and payment providers looking to streamline global transactions.

Conclusion

Fiat currencies and XRP serve different roles in the financial ecosystem. While fiat money remains dominant due to legal tender status and government backing, XRP offers a modern alternative with lower costs, faster transaction speeds, and enhanced security. Understanding these differences empowers businesses and individuals to make the best financial choices based on their needs and objectives.

Comments